Tax Calculator Oklahoma 2025. This tax calculation, produced using the oks tax calculator, is for a single filer earning 50,000.00 per year. The salary tax calculator for oklahoma income tax calculations.

Oklahoma state income tax calculation: That means that your net pay will be $43,803 per year, or $3,650 per.

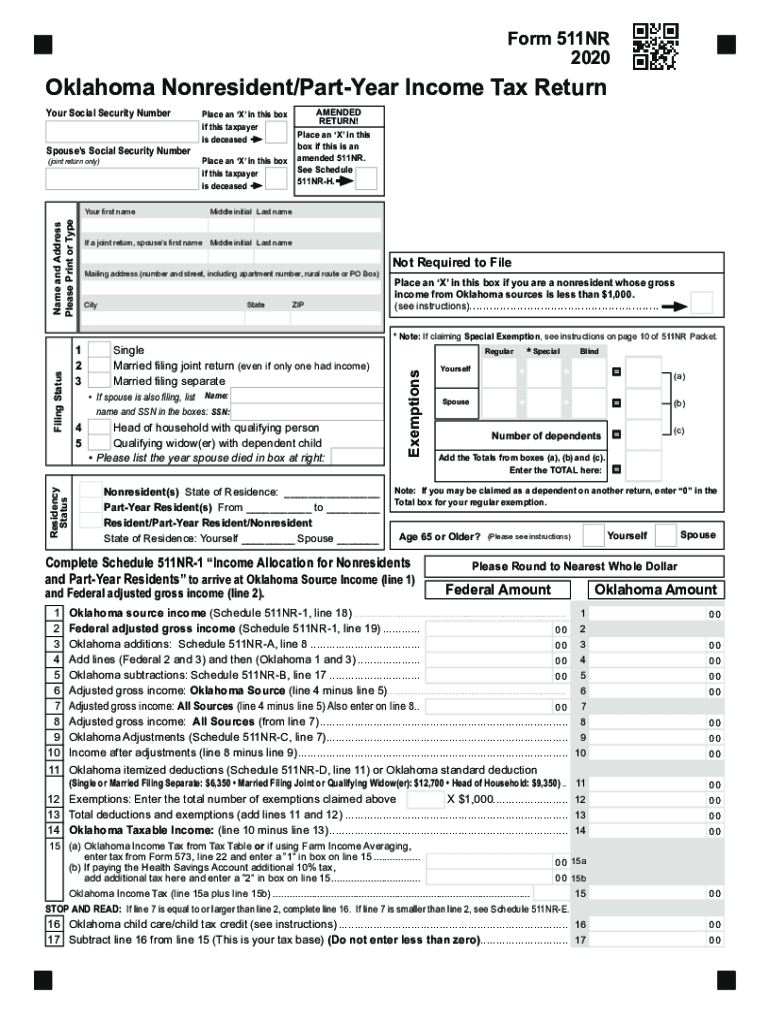

Oklahoma estimated tax Fill out & sign online DocHub, That means that your net pay will be $255,556 per year, or $21,296 per. If you make $400,000 a year living in the region of oklahoma, usa, you will be taxed $144,445.

Tax rates for the 2025 year of assessment Just One Lap, If you make $400,000 a year living in the region of oklahoma, usa, you will be taxed $144,445. If you make $55,000 a year living in the region of oklahoma, usa, you will be taxed $11,198.

2025 Oklahoma State Tax Calculator for 2025 tax return, 50,000.00 salary income tax calculation for oklahoma. 120,000.00 salary income tax calculation for oklahoma.

Oklahoma State Tax S 20202024 Form Fill Out and Sign Printable PDF, 120,000.00 salary income tax calculation for oklahoma. This tax calculation, produced using the oks tax calculator, is for a single filer earning 120,000.00 per year.

Oklahoma State Tax Tables 2025 US iCalculator™, If you make $400,000 a year living in the region of oklahoma, usa, you will be taxed $144,445. 50,000.00 salary income tax calculation for oklahoma.

Oklahoma state tax Fill out & sign online DocHub, The 2025 tax rates and thresholds for both the oklahoma state tax tables and federal tax tables are comprehensively integrated into the oklahoma tax calculator for 2025. 120,000.00 salary income tax calculation for oklahoma.

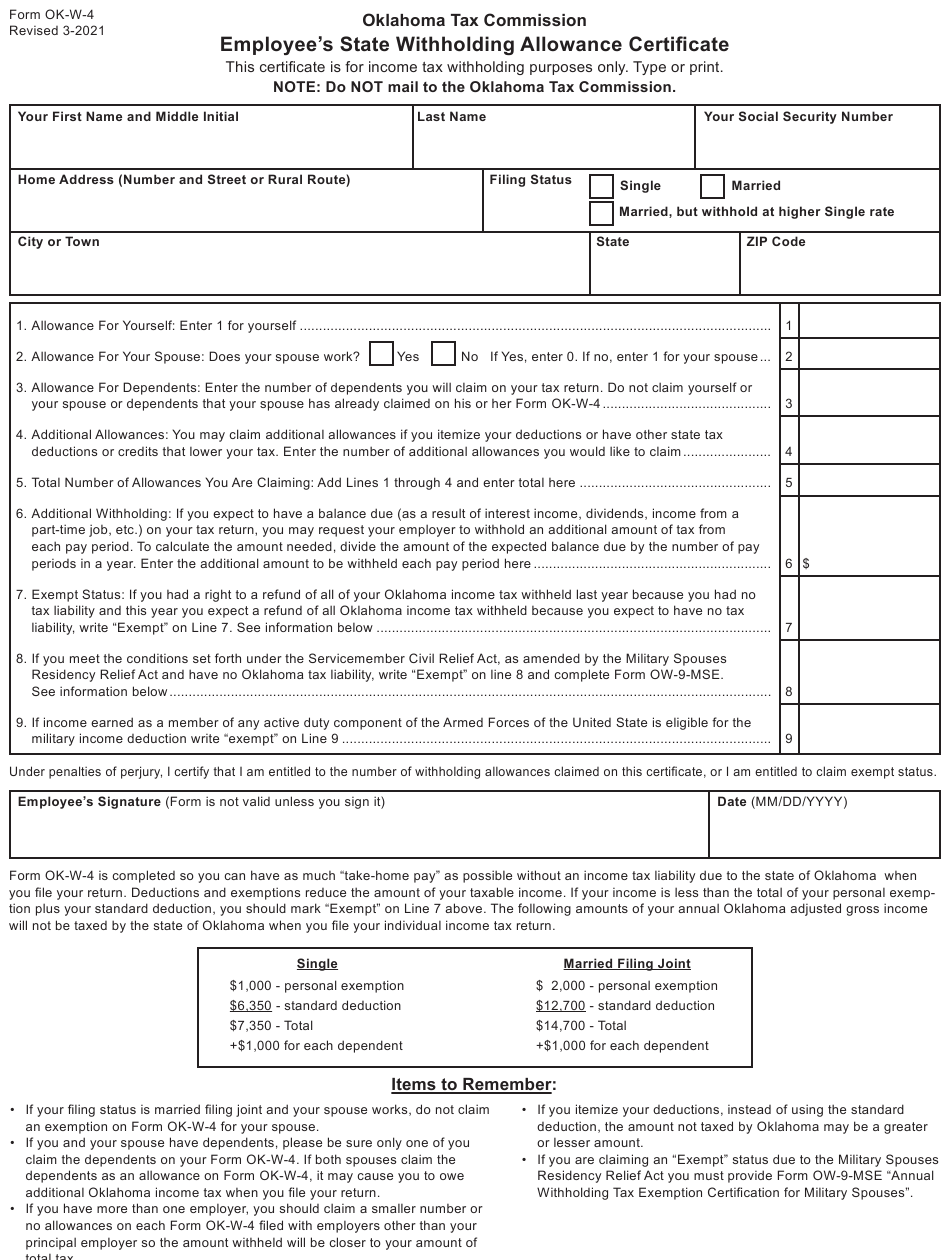

Oklahoma Employee Tax Forms 2025, 50,000.00 salary income tax calculation for oklahoma. The oklahoma tax calculator includes tax.

Oklahoma Tax Commission Forms Fill Online, Printable, Fillable, Blank, Calculate your income tax, social security. 200,000.00 federal and oklahoma tax calculation example with full calculations with supporting oklahoma tax calculator, calculate your own tax return with full deductions.

Oklahoma Sales Tax Guide for Businesses, Estimate your tax liability based on your income, location and other conditions. Oklahoma state income tax calculation:

2025 Bracket Matrix Calculator Helge Brigida, With six marginal tax brackets based upon taxable income, payroll taxes in oklahoma are progressive. If you make $55,000 a year living in the region of oklahoma, usa, you will be taxed $11,198.

Use our income tax calculator to find out what your take home pay will be in oklahoma for the tax year.